If you’re thinking of going solar, now is the time! Solar Incentives such as the Mass Solar Loan and the SREC II are about to change, decreasing your solar savings.

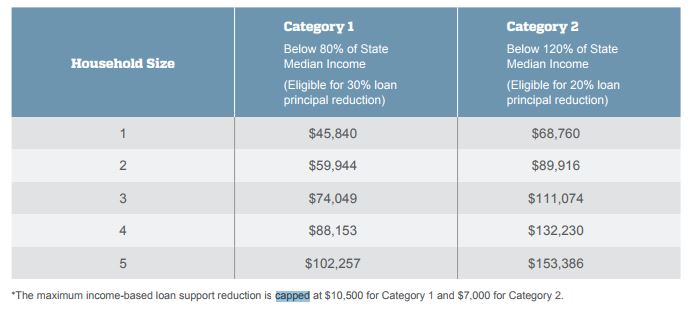

The new program structure will take effect for all loans closed on or after December 13th 2017. If you qualify for 20% IBLS (see chart below), and are thinking about a Mass Solar Loan, you should close on your loan by December 12, 2017. For more information visit the Mass Solar Loan Program website and check out specifically, the Income Based Loan Support (IBLS) feature.

Mass Solar Loan Program

The Mass Solar Loan program is nearing full utilization of the initial program funding (tracked here). This transition steps down loan support while providing additional funding for future program activities that focus on income-qualified customers.

New Mass Solar Loan Program Structure

Moderate Income Customers (Catergory 2) (Between 80% and 120% of State Median Income) – will be eligible for Income Based Loan Support corresponding to 10% of the loan amount, capped at $3,500, and will be able to qualify for Loan Loss Reserve if eligible. Moderate income customers will NOT receive an interest rate subsidy and will receive market rate loans from participating lenders.

Low Income Customers (Category 1) (Below 80% of State Median Income) – the incentives will remain unchanged from the current program structure. Low income customers will be eligible for Income Based Loan Support corresponding to 30% of the loan amount, capped at $10,500, and will be able to qualify for Loan Loss Reserve if eligible. Low income customers will be eligible for a 1.5% Interest Rate Buy Down (the current IRBD rate).

Non-Income Qualified Customers (Greater than 120% of State Median Income) – will not be eligible for any loan support incentives (IRBD, IBLS, and Loan Loss Reserve), however will still be able to take advantage of technical project approval and program structure to seek market rate loans from a participating lender. Standard loan requirements and consumer protections such as the interest rate and closing cost caps will still be applicable for non-income qualified customers.

What this means for you:

If you are interested in utilizing the current Mass Solar Loan Program- please give us a call today. We are happy to help you through the loan process and find a participating lender. We are here to help you go solar!

All the Best,

The Cotuit Solar Team

Your Local Cape & Islands Solar Installer